Itemized Deductions List 2024 Calendar. For the 2024 tax year, the standard deduction is: Itemized deductions include amounts paid for qualified: An itemized deduction is exactly what it sounds like:

An itemized list of the deductions that qualify for tax breaks. Here are the standard deduction amounts for the 2023 and 2024 tax years.

You Choose Between The Two Based On Whether.

For the 2024 tax year, the standard deduction is:

Customized List Of Eligible Expenses;

When they add up to more than the standard deduction, itemized deductions can save more on taxes.

Images References :

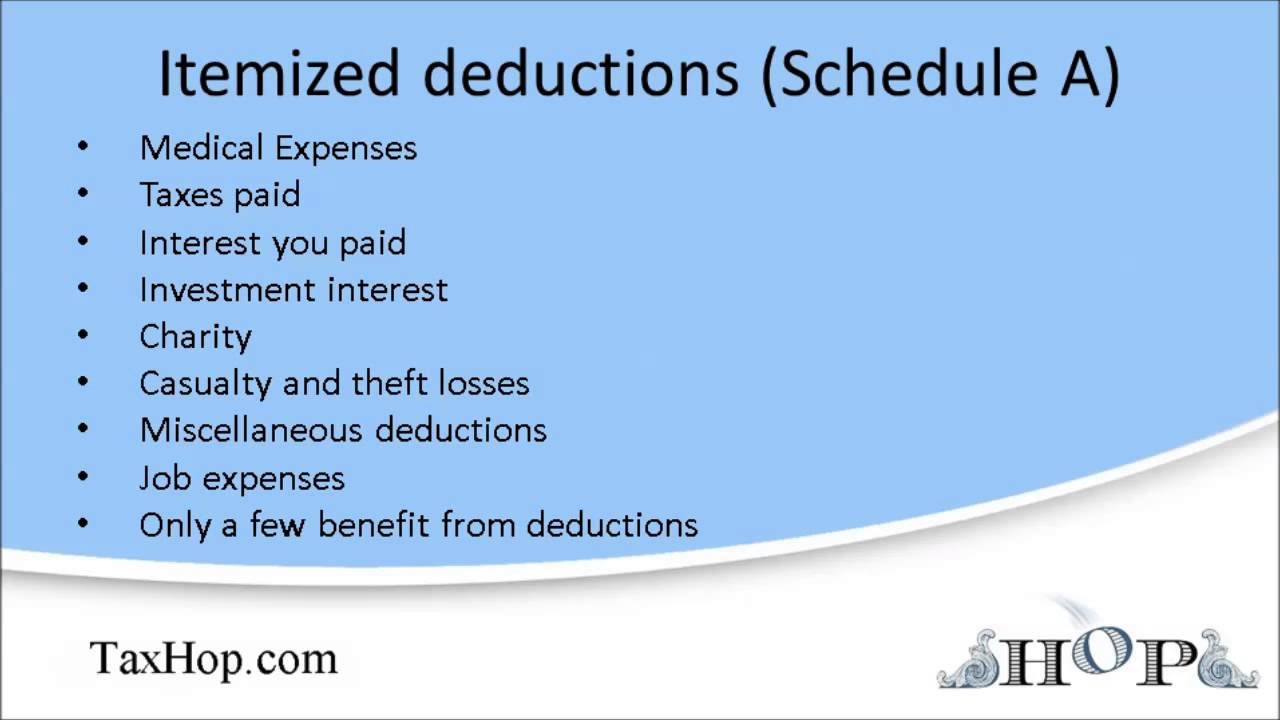

Source: www.turneraccountancy.com

Source: www.turneraccountancy.com

What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform, In 2024, you can gift. Itemized deductions are a list of expenses you could claim on your tax return to reduce your taxable income.

Source: classschoolscherer.z19.web.core.windows.net

Source: classschoolscherer.z19.web.core.windows.net

List Of Items For Itemized Deductions, Itemized deductions involve listing eligible expenses like mortgage interest, state and. In 2024, you can gift.

Source: www.dochub.com

Source: www.dochub.com

Security deposit deductions list pdf Fill out & sign online DocHub, These are the standard deduction amounts for tax year 2023: When they add up to more than the standard deduction, itemized deductions can save more on taxes.

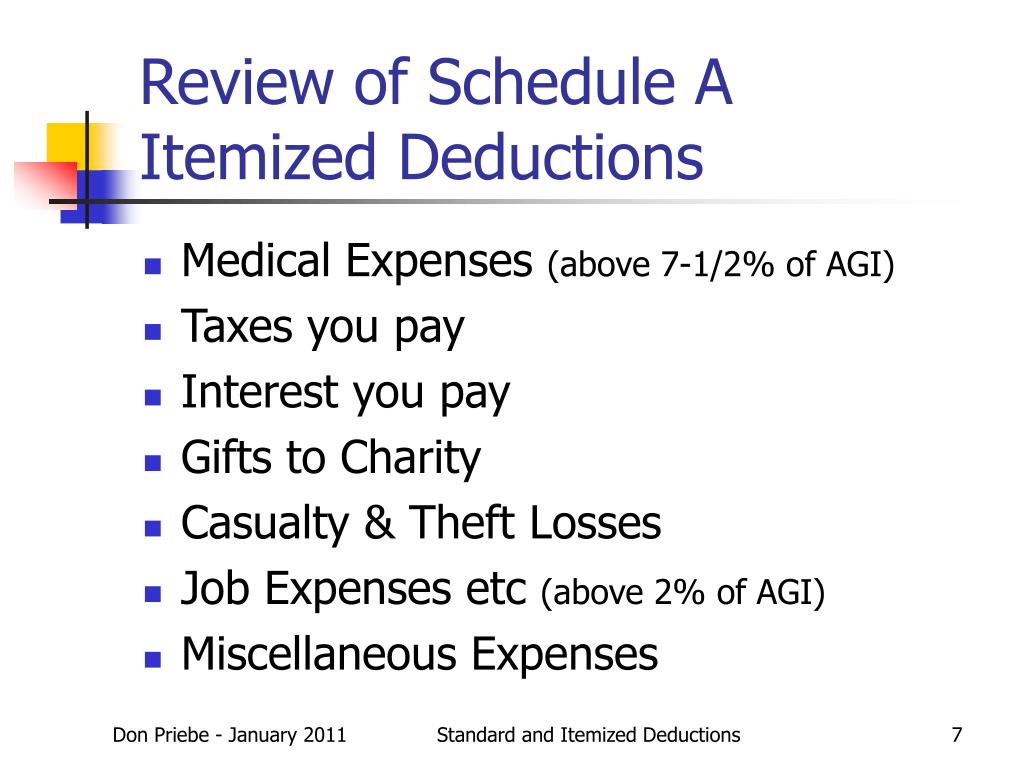

Source: www.slideserve.com

Source: www.slideserve.com

PPT Standard and Itemized Deductions PowerPoint Presentation, free, Can provide greater tax savings, but requires more time and documentation. Information about schedule a (form 1040), itemized deductions, including recent updates, related forms, and instructions on how to file.

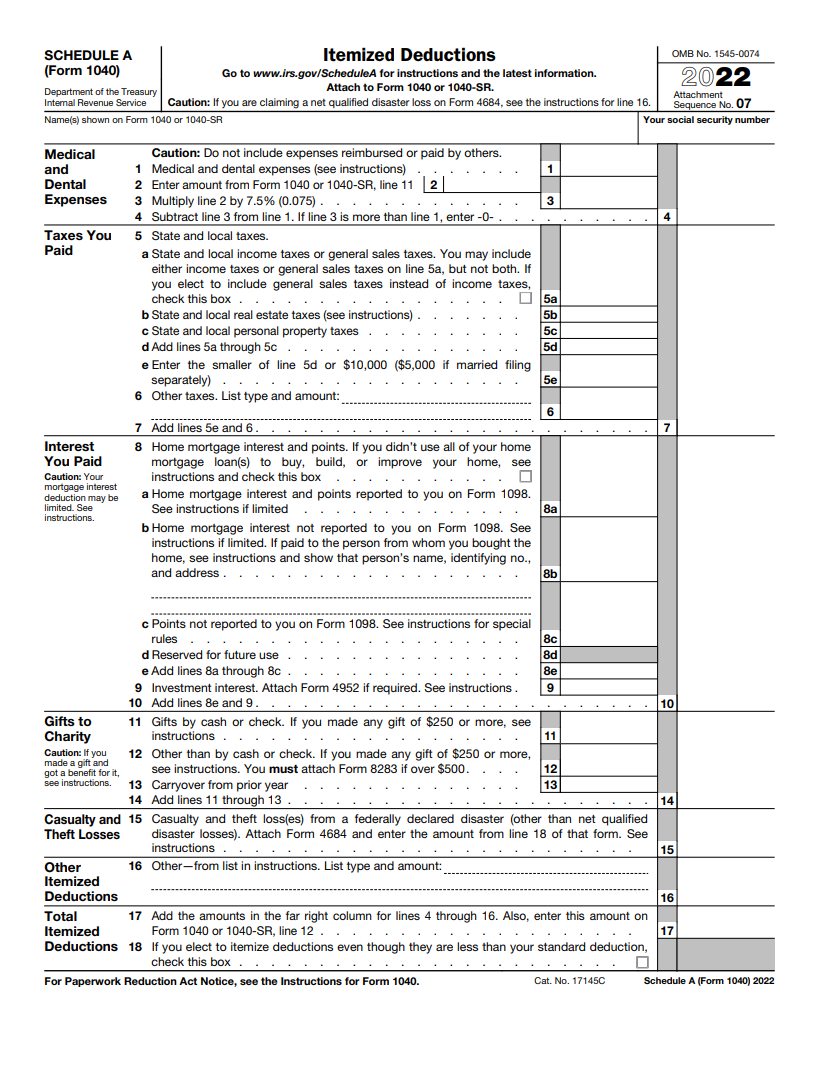

Source: www.signnow.com

Source: www.signnow.com

Itemized Donation List Printable 2022 Form Fill Out and Sign, Itemizing may seem intimidating for some taxpayers but can be a much better option than the standard. Medical and dental expenses that exceed 7.5% of your adjusted gross income.

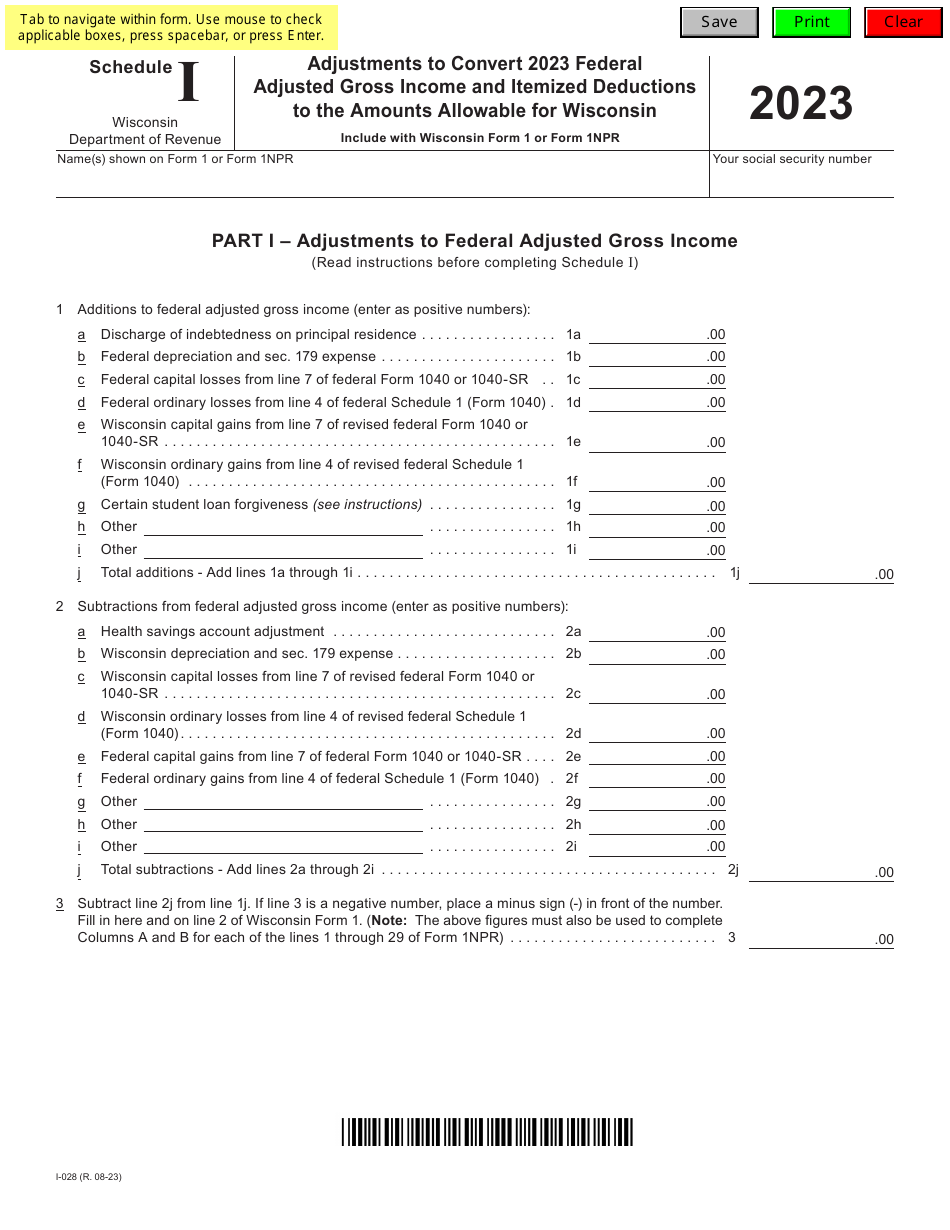

Source: www.templateroller.com

Source: www.templateroller.com

Form I028 Schedule I Download Fillable PDF or Fill Online Adjustments, Medical and dental expenses that exceed 7.5% of your adjusted gross income. Can provide greater tax savings, but requires more time and documentation.

Source: www.bench.co

Source: www.bench.co

Schedule A (Form 1040) A Guide to the Itemized Deduction Bench, $14,600 for single and married filing separately (up from $13,850 in 2023) $29,200 for married couples filing jointly (up from. Explore eligibility, allowable deductions, and.

Source: www.printabletemplate.us

Source: www.printabletemplate.us

Printable Itemized Deductions Worksheet, These income tax slabs and rates apply to individuals (residents below 60 years of age, nr, and nor) for the. Explore eligibility, allowable deductions, and.

Source: materialmagicbaier.z19.web.core.windows.net

Source: materialmagicbaier.z19.web.core.windows.net

Itemized Deductions Worksheet Ca 540, When you file your taxes each year, you have the choice of taking. You choose between the two based on whether.

Source: www.worksheeto.com

Source: www.worksheeto.com

5 Itemized Tax Deduction Worksheet /, $20,800 for head of household; In 2024, you can gift.

Itemized Deductions Are A List Of Expenses You Could Claim On Your Tax Return To Reduce Your Taxable Income.

A deduction cuts the income you're taxed on,.

Total Hra Received From Your Employer.

If you don’t claim 100% of your paid premiums, you can include the remainder with your other medical expenses as an.

Category: 2024